Life Insurance in and around Venice

Get insured for what matters to you

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- SARASOTA

- WELLEN PARK

- NORTH PORT

- PORT CHARLOTTE

- OSPREY

- NOKOMIS

- POLK

- HILLSBOROUGH

- TAMPA

Check Out Life Insurance Options With State Farm

It may make you uneasy to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can express love to the people you're closest to.

Get insured for what matters to you

Now is the right time to think about life insurance

Love Well With Life Insurance

The beneficiary designated in your Life insurance policy can help cover important living expenses for your partner when you pass away. The death benefit can help with things such as ongoing expenses, your funeral costs or college tuition. With State Farm, you can rely on us to be there when it's needed most, while also providing caring, dependable service.

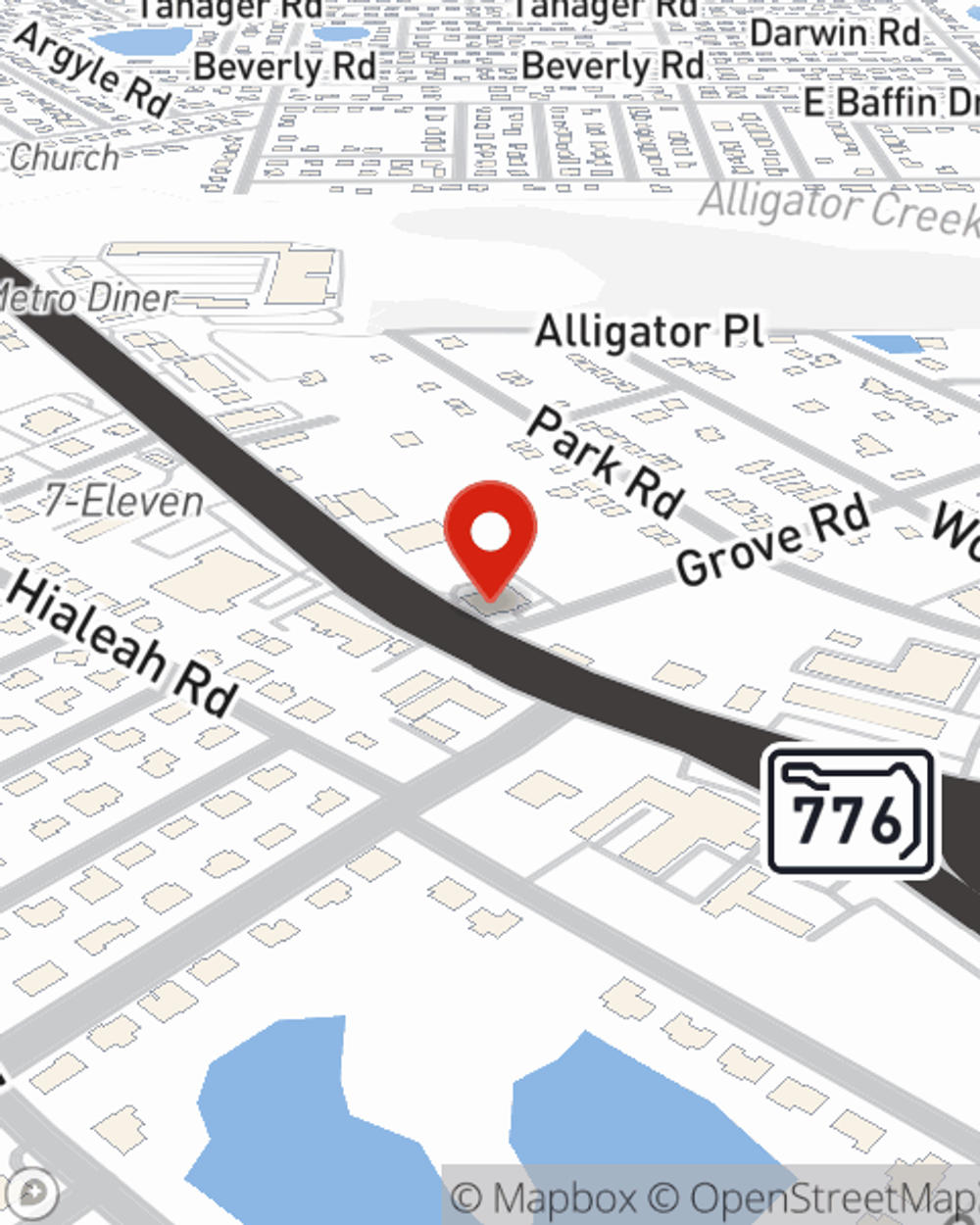

Don’t let the unexpected about your future keep you up at night. Visit State Farm Agent Bethany Bell today and discover how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Bethany at (941) 497-4422 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

Bethany Bell

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.